Hoya Capital Investor Education:

Overview of REITs

What Are REITs?

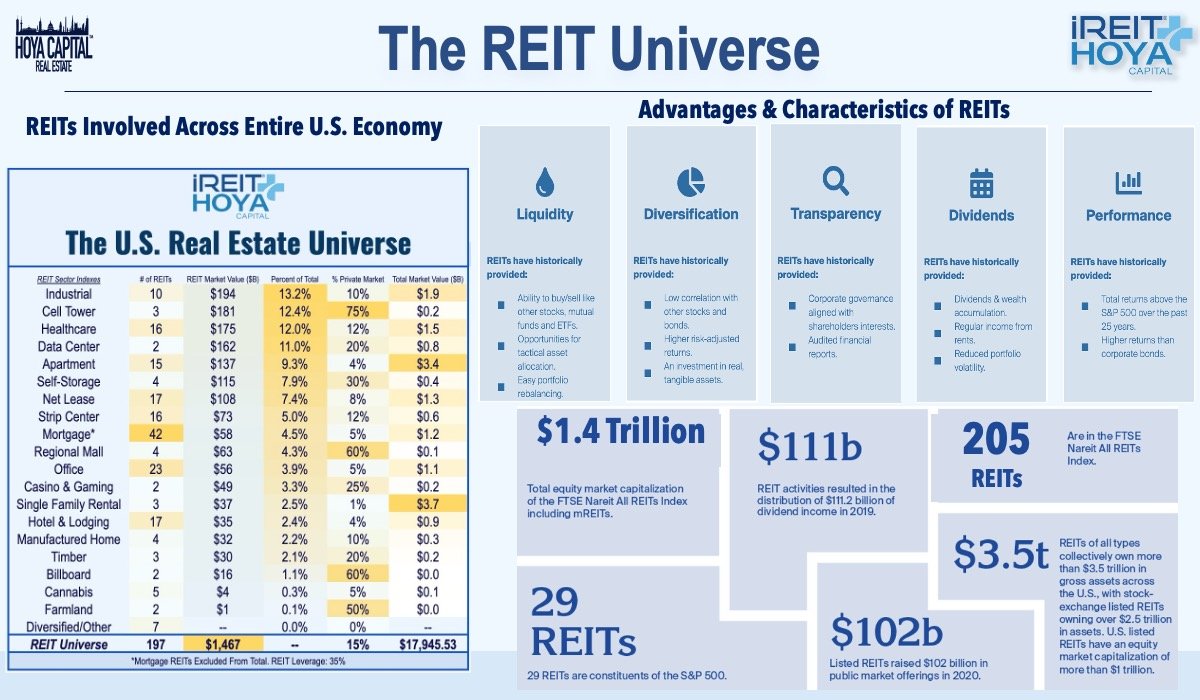

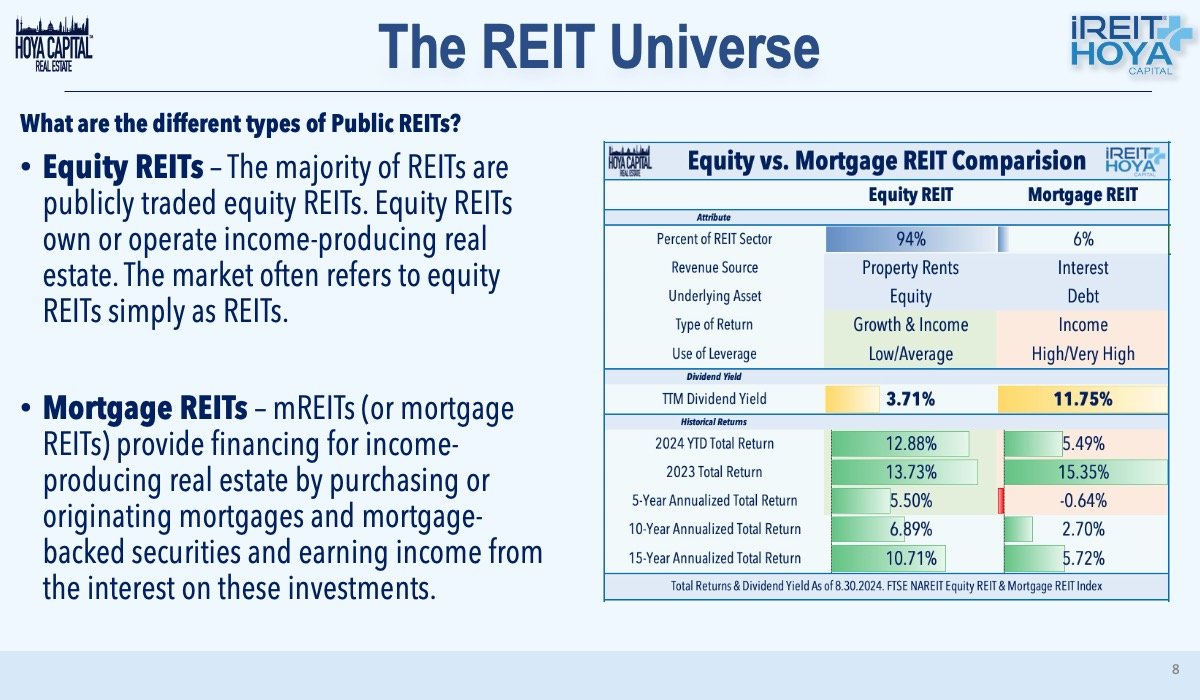

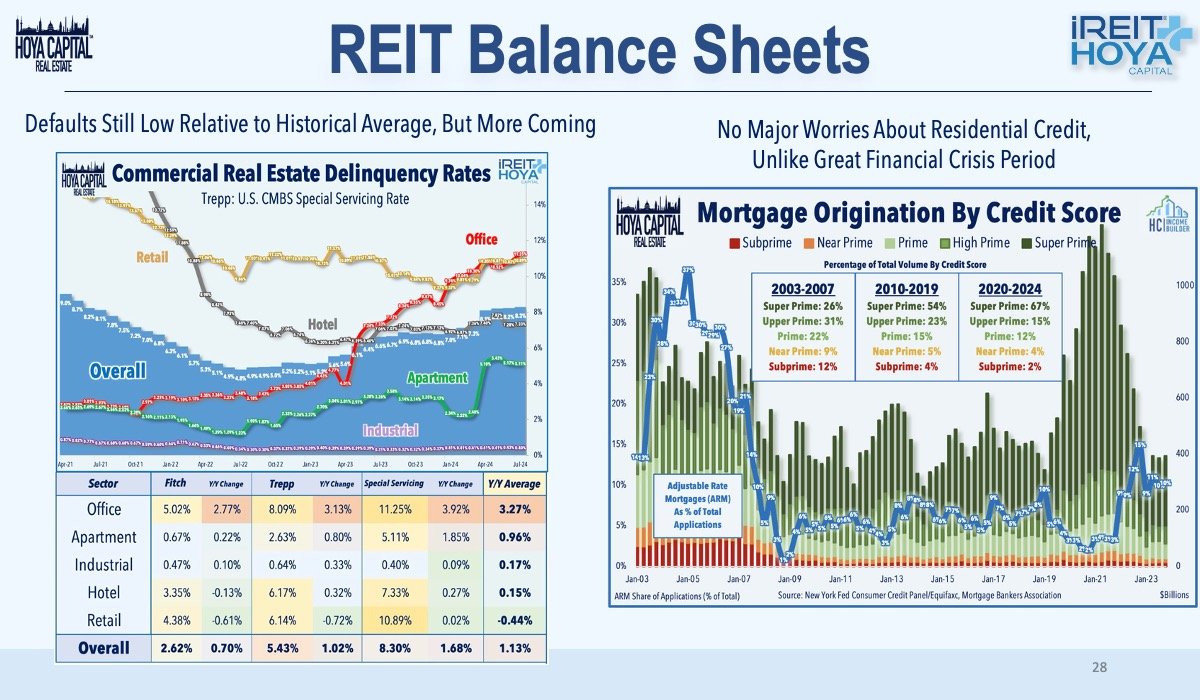

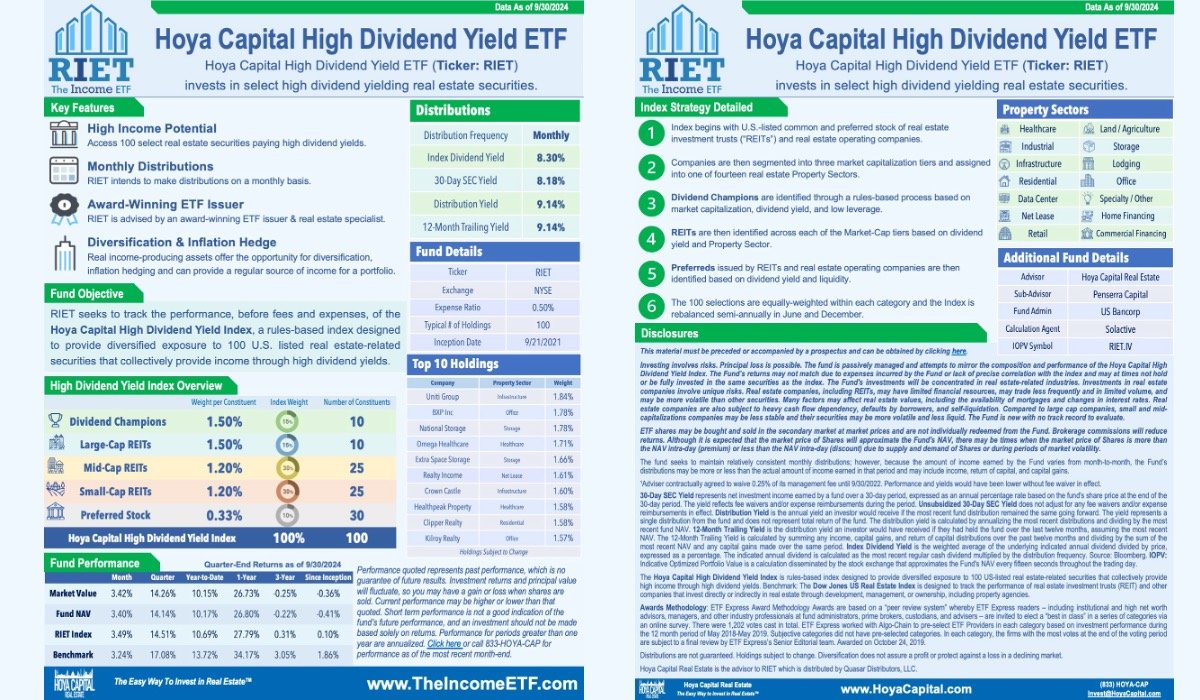

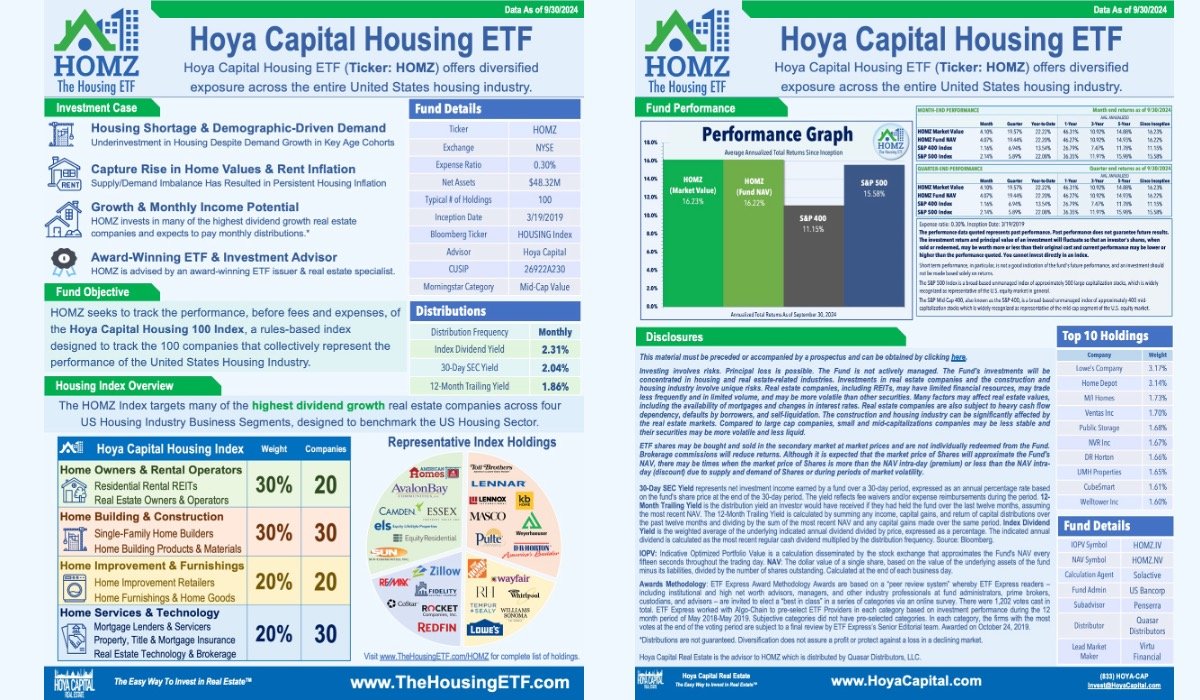

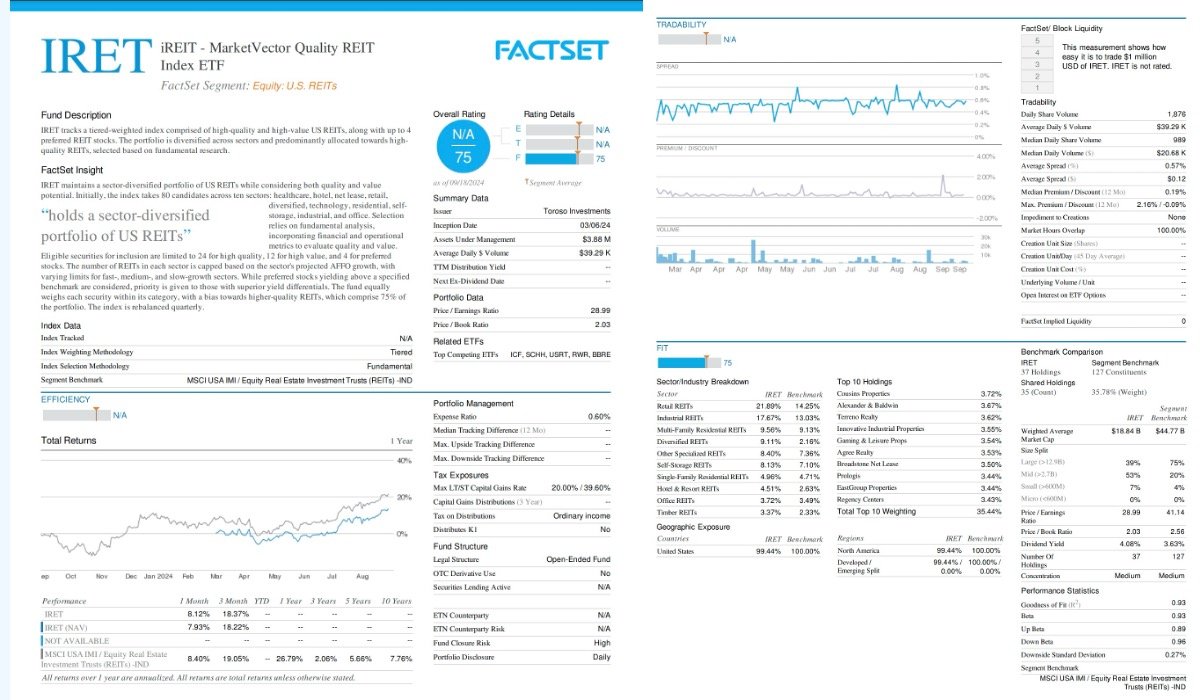

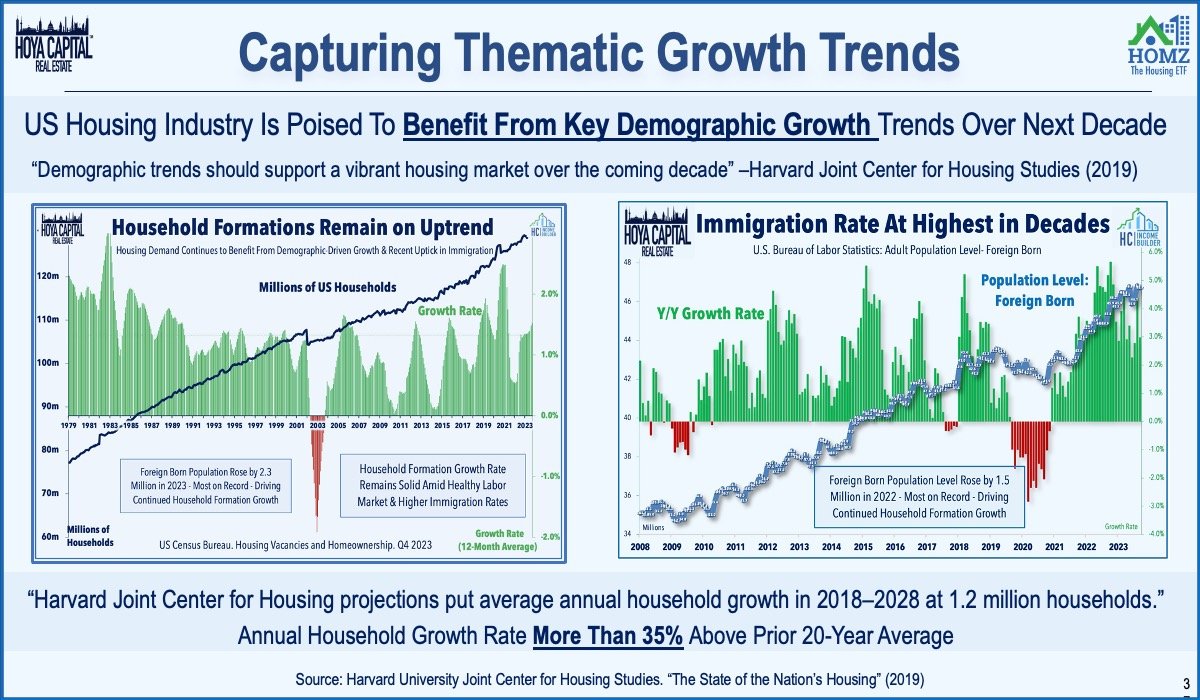

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-producing real estate across a range of property sectors. These trusts provide an opportunity for investors to earn a share of the income produced through commercial real estate without having to directly buy or manage properties. REITs typically invest in properties such as offices, apartments, shopping centers, warehouses, and healthcare facilities.

How Do REITs Work?

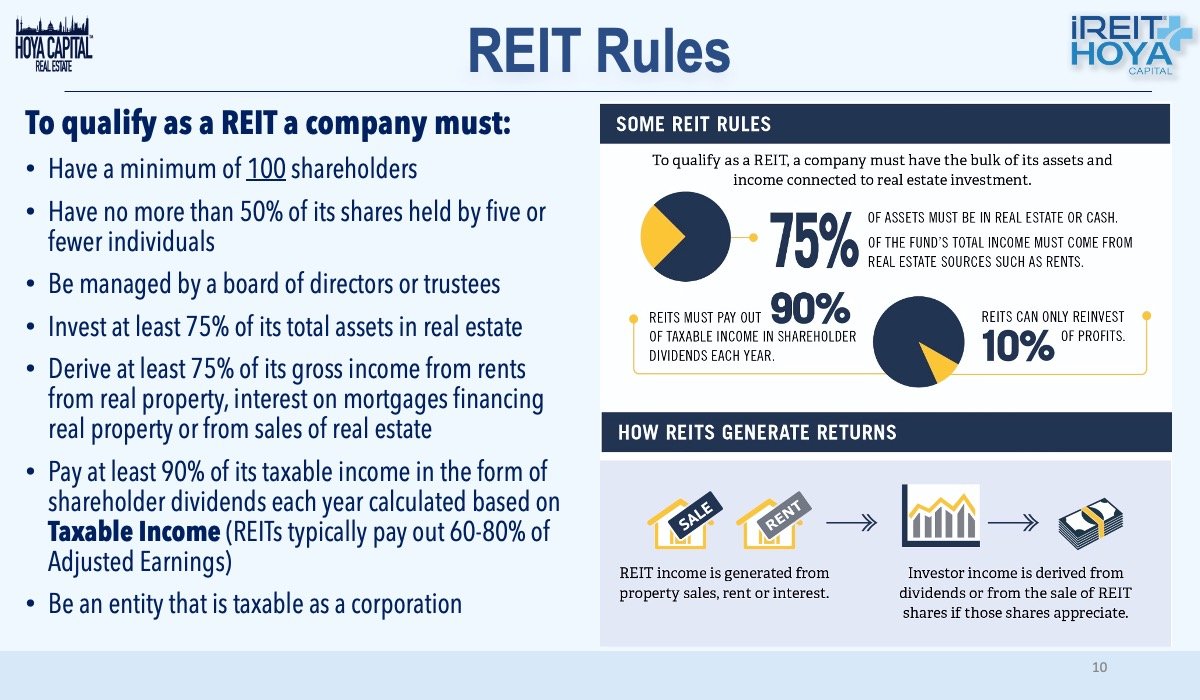

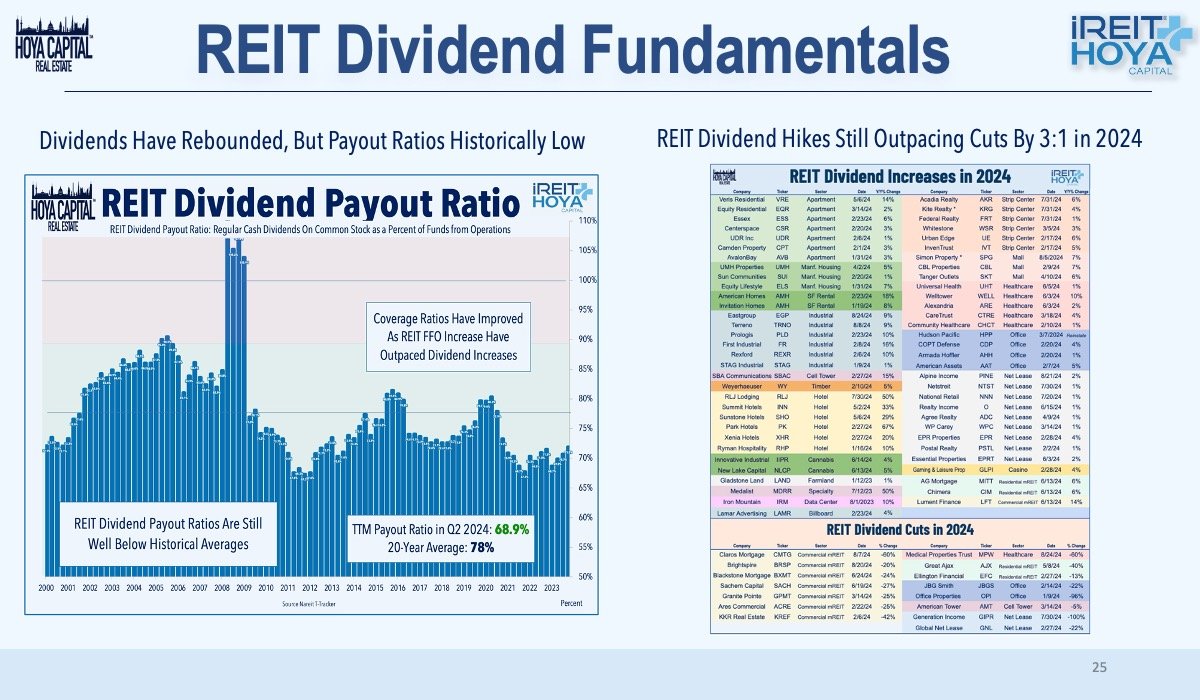

REITs operate by pooling capital from investors to purchase, lease, and manage real estate properties. They then distribute a significant portion of their income, typically 90%, to shareholders as dividends. This model provides a steady cash flow and a low barrier to entry for investors who want to diversify their portfolios into real estate without the need for direct property ownership.

Why Invest in REITs?

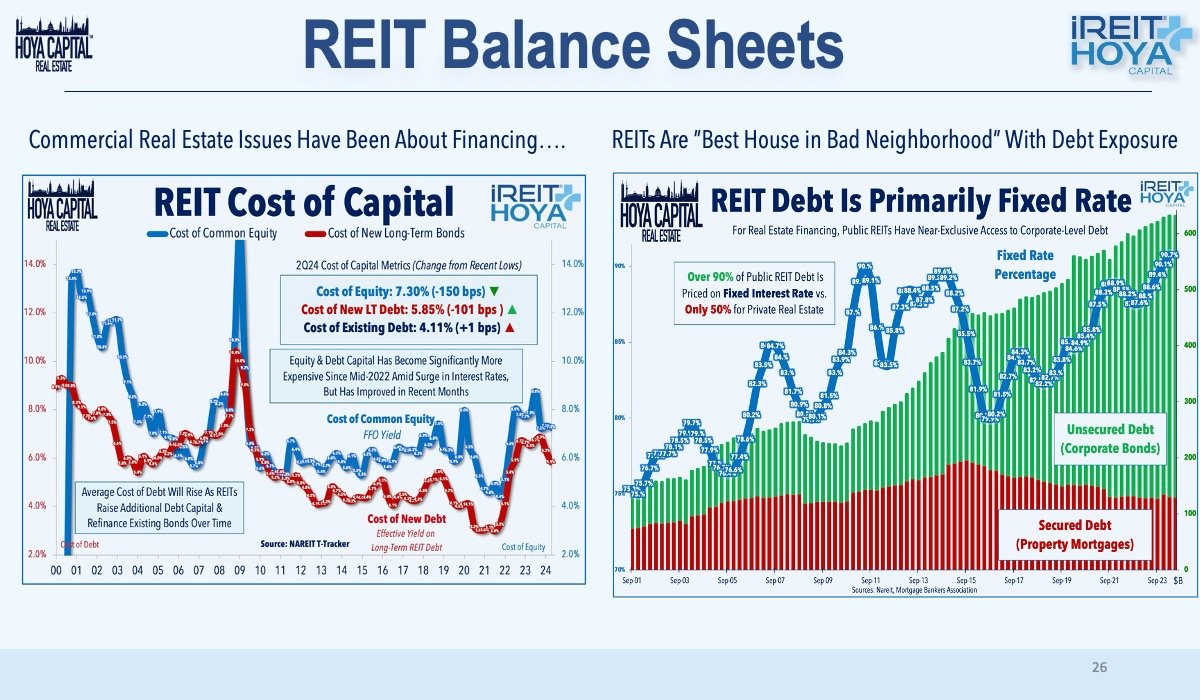

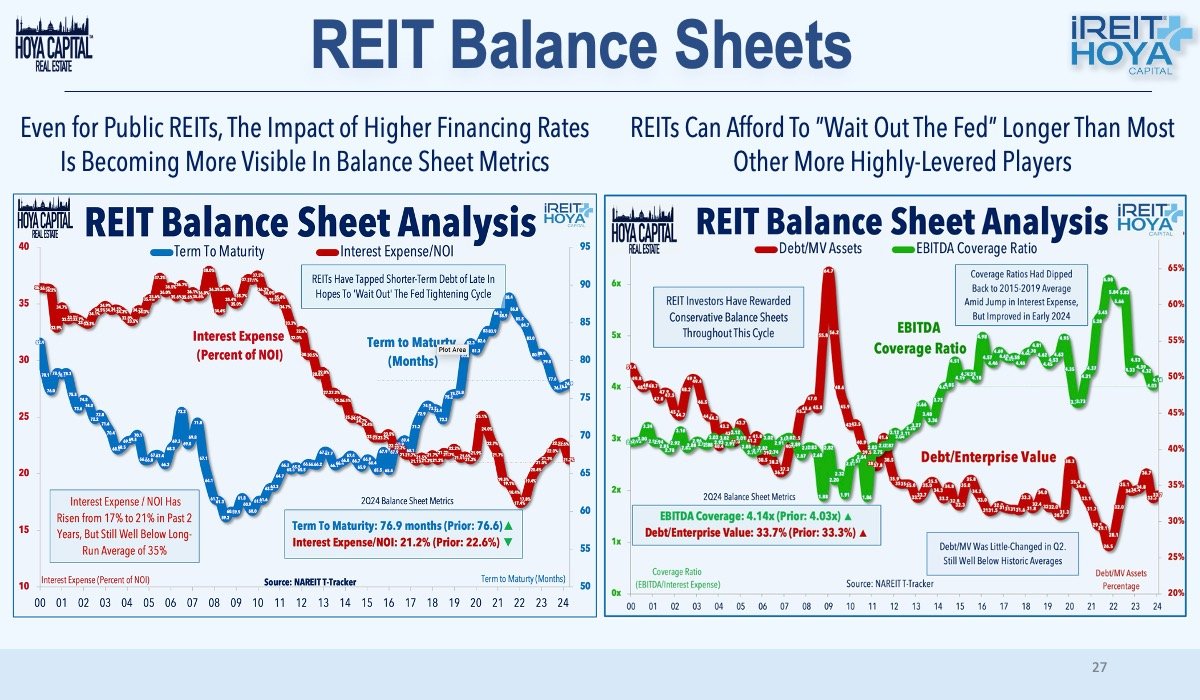

Investing in REITs offers several benefits, including regular income, diversification, and the potential for long-term capital appreciation. They allow individual investors to access real estate markets that may otherwise be out of reach, while offering liquidity since REITs are often publicly traded. REITs also provide diversification across different property types and geographic locations, which can help mitigate risk in an investment portfolio.

Conclusion

REITs are an effective way for investors to add real estate exposure to their portfolios, providing a balance of income generation and growth potential. With their ability to offer high dividend yields, liquidity, and diversification, REITs remain a popular choice for investors seeking a stable, income-generating asset class.